Plenti review: P2P lending for investors

Our verdict

You can get returns of up to 7.5% p.a. and invest from as little as $10.

- Please note that RateSetter Australia rebranded to Plenti on August 10, 2020.

Plenti is a peer-to-peer lender that connects investors with borrowers. While borrowers enjoy competitive interest rates and fees, investors seek out a higher return on their money than what they might normally get with a traditional banking product.

Pros

-

Easy online application

-

Higher potential returns than traditional banking products offer

-

Low minimum deposit

-

No monthly account fees

-

Regular fixed income returns

-

Provision Fund Protection

Cons

-

Return not guaranteed

-

You could lose money

-

Withdrawing funds early may be difficult

Details

Platform details

| Product name | Plenti (Investing) |

| Target interest Rate | up to 7.5% p.a. |

| Investment term | 1 month to 7 years |

| Minimum deposit | $10 |

| Maximum deposit | No limit |

| Account fees | $0 |

| Support | Email, Phone |

Company profile

Plenti was founded in the UK in 2009 and launched operations in Australia in 2014. Today it’s recognised as Australia’s biggest P2P lender with more than 18,000 registered investors and over $600 million in generated loans.

While there are a number of P2P lenders offering loans in Australia, Plenti is one of the few that offers products to everyday investors, not just sophisticated "wholesale" investors.

Main points to consider before investing with Plenti

P2P investing is sometimes seen as an alternative to savings accounts and term deposits, but it is quite different. P2P lending platforms like Plenti are not banks and their products are classified as a managed investment product by the corporate watchdog ASIC.

While P2P investing can deliver higher returns than what you might receive from the bank, there are risks to consider, such as potential losses from borrower default. To offset this risk, Plenti conducts creditworthiness tests and has an additional buffer in the form of its Provision Fund. Plenti says all investors have, to date, received 100% of their principal and interest payments.

What is the Plenti Provision Fund?

The Provision Fund was designed by Plenti to help compensate investors against loss. Borrowers are charged a fee based on their risk profile which is held in the Provision Fund. If borrowers default, investors may have some, or all, of their losses compensated for.What are Plenti’s investment features?

- Investment options. Choose from among five investment choices with term lengths from one month to seven years. You also have a ‘green investment’ option which specifically loans money toward the purchase and installation of renewable energy products.

- Tailored interest rate. You can choose to invest at the most competitive rate on the day, or you can decide on your own rate and wait to be paired.

- Fixed interest investment. When you invest with Plenti you can enjoy regular fixed interest payments every month.

- Loan amount. You can invest as little as $10 and there is no limit on the amount you can invest.

- Provision fund. Plenti’s Provision Fund acts as a buffer against borrower default. It works by transferring some of the borrowers repayments into the fund so that if a borrower misses a repayment the fund may compensate some or all of the investor’s losses.

- No account fees. There are no subscription or account opening fees. Management fees of 10% are deducted from the interest that you earn as an investor, but the market rate you see is net (after fees).

- Reinvestment option. You have the choice of automatically reinvesting your payments into the same fund or a different investment fund altogether.

How do you invest with Plenti?

When you invest with Plenti you’re lending to borrowers that are looking to take out a loan at a competitive rate. As a lender, you’re aiming to get matched to one or several loans that offer a high interest return, while borrowers are seeking to get the lowest rate possible.

The displayed market rate adjusts depending on the supply and demand of loans in Plenti’s marketplace and represents the most competitive investment rate on the day as well as the rate that will get matched most rapidly. For example, if there are more borrowers than investors, rates may increase, and vice versa. To invest with Plenti you must be at least 18 years of age and have an Australian bank account. Individuals, companies, SMSFs and trusts can invest with Plenti. Steps to invest:

1. Open an account. This is relatively simple. You need to provide your name, age, address, tax file number and proof of ID. It should take no more than a couple of hours for your details to get approved. You’ll then need to login and read the product disclosure statement to see your list of investment options.

2. Transfer funds. Before you start investing you’ll need to transfer funds to your Plenti account. You can do this using either BPay or a bank transfer.

3. Select your investment option. There are five investment options to choose from, all five provide monthly payments:

- 1 Month Rolling – Paired with loans of up to three year terms

- 3 Year Income – Paired with three-year loan terms

- 5 Year Income – Paired with five-year loan terms

- National Clean Energy – Paired to loans that are between three and seven years to fund the purchase or installation of clean energy products.

- SA Renewable Energy – Paired to loans between three and seven years that are specifically funding the purchase or installation of Approved Renewable Energy Products in South Australia. Loans terms are between three and seven years

4. Enter your investment amount. You’ll need to enter the amount that you wish to lend. This may be as little as $10 and there is no maximum investment amount.

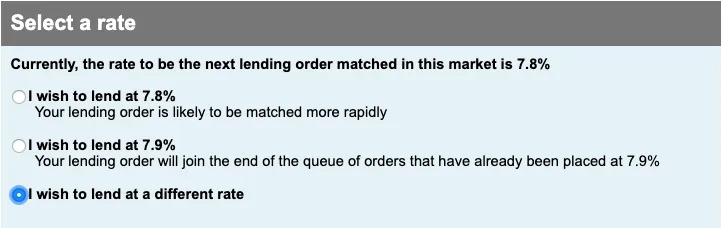

5. Select your rate. You may choose the most competitive (market) rate on the day or, if you think rates will go up, you can enter your own rate and wait to be matched.

How are lenders matched with borrowers?

Lender orders are paired with borrower loans automatically by Plenti depending on term length and the market the investor has chosen to invest in. Lending orders at lower rates are matched first, similar to bidding for shares in a sharemarket.

Investors may be matched with just one loan, but you're typically matched with a portfolio of many loans. Unlike some other P2P platforms, you don’t have a choice in the risk profile of the loans you’re investing in, as this is also managed by Plenti.

Once you’ve been matched, you get an overview of the number of loans and the repayment profiles in your portfolio.

How do you choose a rate with Plenti?

Plenti’s rates fluctuate depending on borrower demand and investor supply. It’s up to you to decide whether the rate is the best you can expect in the short-term.

After selecting your investment choice, you’ll be given the option of the two most competitive rates on the day. If you choose one of these rates, you'll be matched most rapidly, typically within a couple of hours.

Source: Plenti Image

The other option is to select a higher rate of your own choosing if you think rates will go up. The downside of this is it’s difficult to predict how long you’ll need to wait until a loan match is found, plus there’s the risk of losing out on a good rate if they start going down.

For example, if the market rate has never reached 20%, you’re unlikely to paired to a 20% loan in the near future. If not enough borrowers are willing to take out a loan with an interest rate matching what you’ve selected, it could take weeks, months or longer. To get a better idea of the kind of rates you might expect, you have the option of browsing through the rate history.

What are the risks of investing with Plenti?

- You could lose money. There is no guarantee that your investment will return the amount you apply for and, although Plenti says it has not yet had an investor lose money, it’s always a risk. Unlike banking products such as term deposits, you don’t have the government guarantee protection.

- Borrower default or late payment. If one or more borrowers don't repay their loans, it could negatively impact your returns or cause loss.

- Interest rate rise. Like a term deposit, there’s the risk that interest rates will go up before your term is finished, leaving you stuck in an underperforming investment.

- You may not be able to withdraw funds. Exiting from your investment early is at the discretion of Plenti and is dependent on there being sufficient funds to replace your interests. Make sure you understand the risks by reading the PDS.

Frequently asked questions

Your reviews

Kylie Finder

Investments analyst

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.